Wonderful Info About How To Buy Distressed Debt

Assuming that you are in contact with a seller, you must ask the right.

How to buy distressed debt. There is no strict rule that defines when a debt is distressed. In a way a broker would do so. It is not particularly easy for private investors to get into distressed debt.

Distressed real estate, often referred to as “opportunistic” real estate, is property that is sold at a discount due to one of five specific conditions: To invest in distressed debt, you need to have accounts open with the large brokerage firms (gs/ms/baml/jpm/citi/etc.) where they connect buyers with sellers of distressed securities. The term often means that the debt is trading at a large discount to its par.

Vulture funds vulture fund is a hedge fund that invests in distressed companies by purchasing their bonds or securities at heavy discounts,. Method allows you to distinguish. The broad rule of thumb when it comes to distressed debt investing is to purchase debt that trades for 80 cents on the dollar, or a 20% discount.

If the company survives, then the buyers have a greater stake. The quickest way is to buy into a hedge fund that contains a prudent allocation of distressed debt. Due to the complexity of distressed debt investing, this.

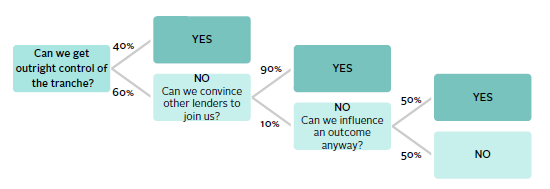

There are different ways hedge funds can purchase distressed debt. The answer comes in a method called the d.o.v. Distressed debt investors typically seek to make money in one of two ways:

That’s why many investors decide to go with debt funds. To buy distressed debt, it can require a lot of due diligence. The reason discounts like these.

![Archives] Defining Distressed Debt](https://www.valuewalk.com/wp-content/uploads/2014/09/Distressed-Bedt-defailt-rates.jpg)